Looking for the best Forex robots to automate your trading? Here’s a quick rundown of the top 10 Forex robots, their features, and performance metrics to help you decide. These tools analyze market data, execute trades 24/7, and remove emotional decision-making, making them essential for consistent trading strategies.

Key Highlights:

- FXStabilizer PRO: Offers 3 trading modes (DURABLE, TURBO, BOOST), supports 8 currency pairs, and delivers stable profits with a 6.09% average monthly gain.

- FX Proctor Special: Focuses on long-term trends, particularly EURUSD and AUDUSD, with dual strategies for precision and frequency.

- FX Proctor: Specializes in AUDUSD trading with a 69.5% win rate and low starting balance requirements.

- Forex inControl 3.0: Trades 4 major pairs with strong risk management and backtested over 18–20 years.

- FX JetBot: High win rate (80%) and monthly profit potential of 130.54%, ideal for aggressive traders.

- FXQuasar: Focused on AUDUSD with a 73% success rate and steady monthly growth of 12.09%.

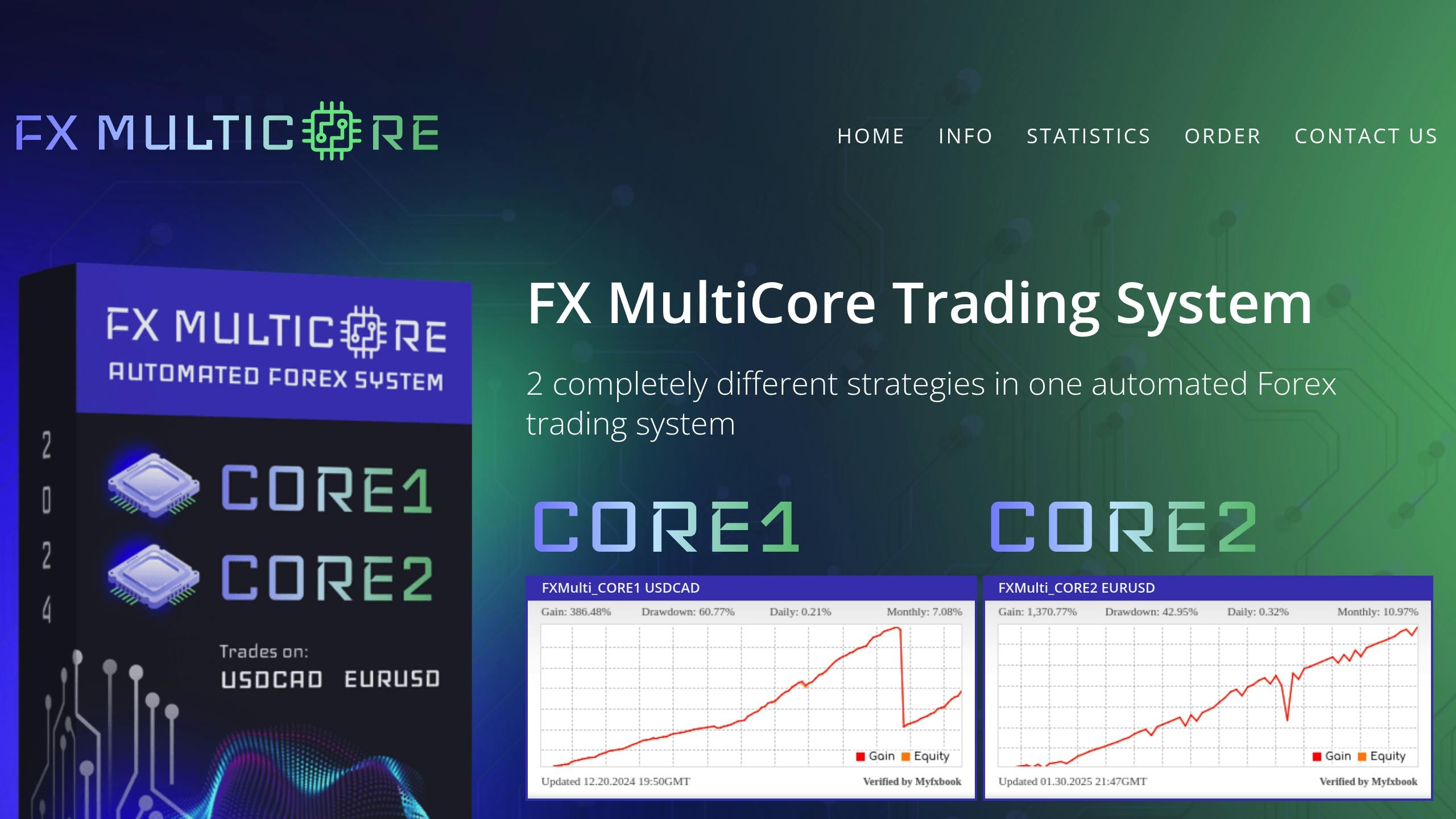

- FX MultiCore: Combines two EAs for EURUSD and USDCAD, balancing risk and profitability.

- FXStabilizer Ultimate: Known for consistent profits since 2015, offering conservative and aggressive trading modes.

- FXTrackPro Super: Trades 6 major pairs with advanced risk controls and an impressive 852.26% total gain in live trading.

- Trader’s Moon: AI-powered, trades 12 pairs, and focuses on the Asian trading session with flexible risk modes.

Quick Comparison:

| Forex Robot | Pairs Supported | Monthly Gain | Max Drawdown | Price | Platforms |

|---|---|---|---|---|---|

| FXStabilizer PRO | 8 pairs | 6.09% | 3.83% | $739 | MT4, MT5 |

| FX Proctor Special | EURUSD, AUDUSD | 10–16% | 16–21% | $379 | MT4, MT5 |

| FX Proctor | AUDUSD | 69.5% win | Low | $289 | MT4, MT5 |

| Forex inControl 3.0 | 4 pairs | 74% win | Controlled | $299–349 | MT4, MT5 |

| FX JetBot | 5 pairs | 130.54% | 46.22% | $345 | MT4, MT5 |

| FXQuasar | AUDUSD | 12.09% | 46.93% | $279 | MT4, MT5 |

| FX MultiCore | EURUSD, USDCAD | 415–803% | 10–33% | $339 | MT4, MT5 |

| FXStabilizer Ultimate | 6 pairs | Consistent | Low | $539 | MT4, MT5 |

| FXTrackPro Super | 6 pairs | 8.18% | 29.43% | $395 | MT4, MT5 |

| Trader’s Moon | 12 pairs | AI-driven | Flexible | $269 | MT4, MT5 |

Pro Tip: Always test these robots on demo accounts before live trading and consider using a VPS for uninterrupted performance. Ready to dive into automated trading? Explore the full details below!

1. FXStabilizer PRO

FXStabilizer PRO has been active since 2015 and supports trading on eight currency pairs: AUDUSD, EURUSD, USDCAD, CHFJPY, EURJPY, EURGBP, USDJPY, and GBPCHF.

One account using this system has reported a 2039% profit since April 2016, with an average monthly gain of 6.09% and a maximum drawdown of 3.83% .

| Feature | Details |

|---|---|

| Trading Modes | DURABLE, TURBO, BOOST |

| Supported Pairs | 8 major currency pairs |

| Minimum Balance | $2,500 (DURABLE), $500 (TURBO) |

| Success Rate | Over 67% |

| Compatible Platforms | MT4 and MT5 |

It offers three trading modes to suit different risk levels:

- DURABLE: Focuses on stability.

- TURBO: Designed for more aggressive trading.

- BOOST: Tested to potentially achieve 100-200% monthly returns .

For those looking for more control, the FXStabilizer Unlocked license removes restrictions on currency pairs and allows full customization of parameters. The system’s algorithms have been rigorously tested on historical data, going as far back as 1997 for AUDUSD . Losses are capped to protect a set portion of your deposit.

To get the most out of FXStabilizer PRO, it’s recommended to use brokers with tight spreads and quick execution times. The robot is priced at $739 and is aimed at serious Forex traders looking for automated trading solutions.

2. FX Proctor Special

FX Proctor Special is a Forex robot that focuses on identifying long-term trends using the D1 (Daily) timeframe. Verified by Myfxbook, its performance shows consistent returns across different trading strategies.

| Trading Path | Start Date | Total Gain | Monthly Gain | Max Drawdown |

|---|---|---|---|---|

| EURUSD Path1 | Dec 28, 2023 | +368.48% | 16.26% | 16.56% |

| EURUSD Path2 | Sep 12, 2023 | +369.06% | 11.48% | 20.02% |

| AUDUSD | Sep 12, 2023 | +309.53% | 10.61% | 21.26% |

For the EURUSD pair, the robot offers two distinct strategies:

- Path 1: Focuses on fewer trades with higher precision.

- Path 2: Adopts a higher trading frequency for more opportunities.

FX Proctor Special is compatible with most brokers and doesn’t require tight spreads to perform well. A starting balance of $500 is sufficient, though larger balances can help reduce risk settings .

The robot employs dynamic algorithms to adapt Take Profit, Stop Loss, and order distances based on market conditions. For managing risk effectively, the developer suggests specific caps depending on the number of pairs traded:

| Number of Pairs | Recommended Risk Cap |

|---|---|

| Single Pair | 40% |

| Two Pairs | 35% |

| Three Pairs | 30% |

| Four Pairs | 25% |

| Five Pairs | 20% |

Users have shared positive experiences. For example, Michael C., an intermediate trader, states:

"My experience with FX Proctor EA has been overwhelmingly positive. The dual preset settings allow me to adjust trading strategies based on market conditions, and I’ve seen great returns!"

Priced at $379, the package includes MT4 and MT5 versions, free updates, and round-the-clock technical support. It also comes with a 30-day money-back guarantee if losses exceed 35% .

Currently, FX Proctor Special supports AUDUSD and EURUSD pairs , making it a strong choice for traders focusing on these currencies. Its blend of accuracy and adaptability ensures consistent performance.

3. FX Proctor

FX Proctor is a Forex robot focused on trading the AUDUSD pair, priced at $289, with a Special version also available . It uses daily trend analysis to guide its trades, delivering the following performance metrics :

| Metric | Value |

|---|---|

| Win Rate | 69.5% |

| Profit Factor | 1.70 |

| Average Daily Trades | 1.3 |

| Total Pips Gained | 216.6 |

The robot uses algorithms to fine-tune settings like Take Profit, Stop Loss, and order distances, ensuring steady performance in various market conditions . It works well without needing very tight spreads, making it suitable for a broad range of Forex brokers . You can start with as little as $500, though larger accounts allow for more cautious risk configurations .

FX Proctor has earned a 9.8/10 rating, thanks to its reliable performance, in-depth market analysis, verified Myfxbook results, and dependable technical support. However, it only supports AUDUSD trading and follows a long-term strategy .

Technical Requirements for FX Proctor

To run FX Proctor efficiently, your system should meet these specifications:

| Requirement | Minimum | Recommended |

|---|---|---|

| RAM | 4 GB | 16 GB |

| CPU Cores | 2+ | 4+ |

| CPU Usage | <85% | <50% |

| Internet Speed | 1 Mbps | 12 Mbps |

The package includes regular updates, 24/7 technical support, and a 30-day money-back guarantee . These features make FX Proctor an attractive option for traders focused on the AUDUSD pair.

4. Forex inControl 3.0

Forex inControl 3.0 offers a mix of tools aimed at stable trading with a focus on risk management and multi-currency trading. It comes in two pricing options: $349 for the COMPLETE version and $299 for the STANDARD version .

This EA trades across four major currency pairs – AUDUSD, EURGBP, EURJPY, and USDCAD – providing diversification to help balance potential losses with gains . Here’s a snapshot of its recent performance:

| Performance Metric | Value |

|---|---|

| Win Rate | 74% |

| Total Completed Orders | 132 |

| Minimum Required Leverage | 1:200 |

| Backtesting Period | 18–20 years |

One of its key features is the "Hard Control of Drawdown" system, which lets traders set precise maximum drawdown levels . The COMPLETE version also includes flexible risk management settings:

| Number of Pairs | Maximum Risk Per Trade |

|---|---|

| 1–2 pairs | Up to 35% |

| 3 pairs | Up to 30% |

| 4 pairs | Up to 25% |

"The most important thing in Forex trading is not to lose your deposit. That is why you need a proper money management. Our EA allows to specify a maximal possible drawdown precisely, so that under any circumstances you wouldn’t lose more than expected."

– Forex inControl Website

The EA avoids high-risk strategies like Martingale, arbitrage, or scalping. Instead, it waits for favorable market conditions and uses automatic StopLoss settings to manage trades effectively .

Forex inControl 3.0 works with both MT4 and MT5 platforms, catering to a wide range of traders . It also includes an intelligent money management system that calculates optimal lot sizes and trading opportunities before taking positions . Using VPS hosting can further enhance stability and execution speed in automated trading.

For best results, traders should use accounts with at least 1:200 leverage . The EA’s reliability is backed by extensive backtesting over 18–20 years on each currency pair, showcasing its ability to adapt to various market conditions .

5. FX JetBot

FX JetBot operates on pairs like AUDUSD, EURJPY, EURGBP, USDCAD, and EURUSD . Its algorithm is designed to pinpoint trading opportunities while keeping potential losses in check .

Here’s a snapshot of its live trading performance:

| Performance Metric | Value |

|---|---|

| Win Rate | 80% |

| Daily Return (Compound) | 2.82% |

| Monthly Profit Level | 130.54% |

| Maximum Drawdown | 46.22% |

| Profit/Drawdown Ratio | 3:1 |

| Average Trades per Day | 1.6 |

These numbers highlight FX JetBot’s calculated and steady approach. It avoids high-risk tactics by sticking to fixed lot sizes in 96.5% of trades .

According to FXSherlock:

"FX JetBot EA is a new Forex robot on ForexStore that is showing great achievements in terms of account growth and durability. This mainly is because the system has got a really powerful algorithm that very effectively finds the Market entry points and manages losses by a built-in loss limitation system."

Key Risk Management Features

FX JetBot incorporates several measures to manage risk and enhance performance:

- Loss Limitation System: Automatically caps potential losses.

- Fixed Lot Trading: A cautious approach that avoids risky strategies like Martingale.

- Recovery Strategy: Focuses on maximizing pip gains from winning trades to balance out losses.

- Grid Strategy: Occasionally used to close both losing and winning trades simultaneously.

Pricing and Compatibility

FX JetBot is available for $345, which includes free updates and support. It requires a minimum deposit of $190 . For best results, running it on a VPS is recommended, especially with Tickmill Forex brokers using TradingFX VPS services .

The bot works seamlessly with MetaTrader 4 and MetaTrader 5 platforms and adheres to NFA compliance standards . Impressively, one live trading account reported a gain of +1,297.55% .

FX JetBot has received positive feedback, earning a 4/5 rating from ForexStore and 8/10 from its automated system.

6. FXQuasar

FXQuasar is a forex robot specifically designed for the AUDUSD currency pair. It operates across six trading sessions – three for long positions and three for short positions – making it a focused tool for traders aiming to maximize gains in this market.

Performance Metrics

| Metric | Value |

|---|---|

| Success Rate | 73% |

| Monthly Growth | 12.09% |

| Maximum Drawdown | 46.93% |

| Total Profit Level | 1653.85% |

| Average Monthly Trades | 20 |

These numbers provide a clear snapshot of FXQuasar’s trading efficiency and potential profitability.

Trading Strategy and Features

FXQuasar uses advanced algorithms to analyze market quotes and pinpoint entry opportunities . Between July 2020 and November 2021, a live account that started with $2,000 achieved a 466% profit over 16 months. This was accomplished with steady growth and controlled drawdowns .

Risk Management System

To minimize potential losses, FXQuasar includes a risk management system. Traders are encouraged to set a risk limit of up to 35% to safeguard their accounts . This approach has helped the robot maintain a track record of three profitable trades for every losing one .

According to FXSherlock:

"FXQuasar is one of those Forex trading systems that might not be claimed best but is still well-crafted and does its work pretty well… So, the FXQuasar Forex robot looks like quite a workhorse that might be bringing profits and still keeping your funds safe from losses."

Technical Specifications

FXQuasar works with MetaTrader 4 and MetaTrader 5 platforms. It’s priced at $279, which includes a single license, free updates, and ongoing support . Its strong performance and user satisfaction have earned it high ratings on ForexStore .

For optimal results, run FXQuasar on a VPS to ensure continuous operation and low latency. The system adjusts to market conditions by analyzing price patterns over multiple days .

sbb-itb-049b7c8

7. FX MultiCore

FX MultiCore is a trading system that combines two expert advisors – CORE1 and CORE2 – to balance risk and improve performance. CORE1 focuses on USDCAD, using higher timeframes and a modified grid strategy with fixed lot increments to recover losses. Meanwhile, CORE2 trades EURUSD, leveraging layered Moving Average signals to define custom Take Profit and Stop Loss levels, alongside a lot multiplication recovery approach .

Here’s a breakdown of their live performance metrics :

| Metric | CORE1 | CORE2 |

|---|---|---|

| Currency Pair | USDCAD | EURUSD |

| Profit Growth | +415.73% | +803.69% |

| Maximum Drawdown | 10.32% | 32.88% |

| Win Rate | 70% | 80% |

| Max Orders | 3 | 1 |

CORE1 began trading in January 2023 with an initial deposit of $1,100, achieving a +415.73% profit in 15 months while maintaining a low 10.32% drawdown. CORE2, starting in November 2022 with $1,000, delivered a remarkable +803.69% profit .

FX MultiCore works with both MT4 and MT5 platforms, requires a minimum deposit of $200, and is priced at $339 .

"The FX MultiCore EA stands out as a robust and reliable automated trading system…Its strategic use of a modified grid trading approach, coupled with a compound interest strategy, allows for consistent profitability and effective risk management."

The system includes advanced tools for managing drawdown. For example, a refund policy is in place if drawdown exceeds 35% when using the recommended settings. By combining two different trading strategies and currency pairs, FX MultiCore spreads risk effectively, leading to more consistent results overall .

8. FXStabilizer Ultimate

FXStabilizer Ultimate is an expert advisor (EA) known for delivering steady monthly profits since 2015. It trades six major currency pairs – EURUSD, AUDUSD, USDCAD, CHFJPY, EURJPY, and EURGBP – on the H1 timeframe.

One of its standout features is its dual operating modes. Durable mode requires a minimum deposit of $2,500 and focuses on a conservative, lower-risk strategy. On the other hand, Turbo mode allows traders to start with as little as $500, offering a more aggressive trading approach.

The EA is equipped with advanced drawdown controls and boasts extensive backtesting data, with some pairs tested as far back as 1997. It claims a success rate of over 67% . Using sophisticated algorithms, FXStabilizer Ultimate identifies optimal trade opportunities while maintaining strict risk management practices. The software is priced at $539 and includes a 30-day money-back guarantee .

Here’s how FXStabilizer Ultimate stacks up against its counterpart, FXStabilizer PRO:

| Feature | FXStabilizer Ultimate | FXStabilizer PRO |

|---|---|---|

| Currency Pairs | 6 pairs | 8 pairs |

| Trading Modes | Durable, Turbo | Durable, Turbo, Boost |

| FXStabilizer Unlocked License | Not included | Included |

| Price | $539 | $739 |

ForexStore.com rates FXStabilizer Ultimate at 9.5/10 , emphasizing its reliable performance and consistent profitability.

9. FXTrackPro Super

FXTrackPro Super is an Expert Advisor designed to trade six major currency pairs: EURUSD, USDCAD, GBPUSD, EURJPY, USDJPY, and AUDUSD. Its algorithm uses three different types of indicators to adjust to market changes and identify optimal trade entry points. With over two years of live performance, it has delivered impressive results.

In 920 days of live trading, the EA achieved a total gain of 852.26%, averaging 8.18% monthly returns. During its first five months on a six-pair account, it generated a 462.98% profit with a maximum drawdown of 29.43% .

Here’s a breakdown of its performance across accounts:

| Currency Pair | Profit | Maximum Drawdown |

|---|---|---|

| EURUSD | 202.26% | 30.66% |

| USDCAD | 241.51% | 30.54% |

| Multi-pair | 462.98% | 29.43% |

FXTrackPro Super is equipped with advanced risk management features, including StopLoss protection, market order analysis, forced order closing, and a Martingale-based lot size adjustment. It works seamlessly on both MetaTrader 4 and MetaTrader 5 platforms.

Priced at $395, the EA comes with a 30-day money-back guarantee if the drawdown exceeds 35% under recommended settings .

"FXTrackPRO is a very profitable Expert Advisor that can quickly increase your capital, but more importantly, its profitability allows you to trade a small part of your deposit and still have a pretty solid profit. Low risks with significant profits!" – Forex Store

Forex Store rates FXTrackPro Super 8.5/10 , praising its steady performance and effective risk controls. Its profitability-to-drawdown ratio, ranging from 3:1 at its peak to 1.3:1 at its lowest, highlights its ability to deliver strong returns while managing risk effectively.

10. Trader’s Moon

Trader’s Moon leverages neural networks and deep learning to analyze and capitalize on market cycles. It works seamlessly with both MetaTrader 4 and MetaTrader 5, focusing on 12 key currency pairs.

This EA combines Bollinger Bands, the Commodity Channel Index, and candlestick patterns to guide its trades. One standout feature is its emphasis on the Asian trading session, where lower market volatility often allows for better entry prices. This approach has shown consistent results over time.

Interestingly, two separate studies revealed that strategies based on lunar cycles outperformed market returns by 3.3% annually over 20 years and 6.8% annually over five years .

Risk Management Modes

Trader’s Moon offers three different modes to suit various risk appetites:

| Mode | Minimum Capital | Risk Level | Recommended Risk Setting |

|---|---|---|---|

| Safe | $5,000 | Low | 50% or less |

| Average | $3,000 | Medium | 35% or less |

| Aggressive | $1,500 | High | 25% or less |

Additional features include filters for managing open trades, drawdown limits, and real-time news analysis. Priced at $269, the package includes a single license, regular updates, and dedicated customer support.

Users often highlight its AI-powered insights and steady win rates, although occasional drawdowns are to be expected.

For the best results, consider running Trader’s Moon on a VPS (like Ubuntu 20.04 LTS) to reduce latency during the Asian trading session.

Why Use VPS for Forex Trading

Forex robots thrive in a stable, high-speed environment, and a VPS provides exactly that. A VPS ensures consistent, around-the-clock performance, which is essential for trading where precision and speed are everything. Even a one-second delay can lead to missed opportunities, costing traders an average of $100,000 annually due to slippage and other issues . For instance, while home MT4 setups typically face delays of around 800ms, a VPS can cut execution times down to just 5ms .

Key Performance Benefits

| Aspect | Home Computer | VPS Solution |

|---|---|---|

| Uptime | Subject to local issues | 99.9% guaranteed |

| Execution Speed | ~800ms average | As low as 5ms |

| Power/Internet | Vulnerable to outages | Uninterrupted performance |

| Resource Usage | Shared with other tasks | Dedicated to trading |

| Location | Fixed | Adjustable for broker proximity |

These improvements create a more reliable trading setup, minimizing disruptions and delays.

Server location also plays a major role. In July 2024, a QuantVPS user named Charles shared his experience: "QuantVPS has changed the game for me, no more dealing with slippage because the server is so close to the CME. My trades are lightning fast using ninjatrader 8" . This highlights how proximity to your broker’s data center can drastically reduce latency.

Although a VPS typically starts at around $28 per month, the benefits – like low-latency execution, uninterrupted operation, enhanced security, and dedicated resources – justify the cost . This is particularly true when running multiple Forex robots, where system stability is critical.

"Forex robot VPS is a solution designed specifically for forex traders to provide a stable, high-speed trading environment." – VPS-Mart.com

To get the most out of your Forex robots, look for a VPS provider that offers:

- Servers near your broker’s data centers

- Adequate RAM and CPU tailored to your trading needs

- 24/7 technical support during trading hours

- Regular backups and strong security measures

These features ensure your trading setup remains reliable and efficient.

Summary

When selecting a Forex robot, focus on performance metrics that matter most. Automated trading systems now drive 60-80% of the total Forex market turnover , underscoring their growing role in trading.

Here are some key factors to evaluate:

| Selection Criteria | Key Considerations |

|---|---|

| Performance History | Look for verified track records and backtesting results. |

| System Requirements | Ensure compatibility with your platform and VPS setup. |

| Risk Management | Check for built-in safeguards and drawdown limits. |

| Market Adaptation | Opt for algorithms that can adjust to changing markets. |

| Support & Updates | Reliable vendors should offer regular updates and support. |

These factors align with the earlier insights on performance and risk management.

Creating the right trading environment is just as important. While free robots might work for some, paid options often come with advanced features and better support.

Best practices for success:

- Test robots thoroughly using demo accounts.

- Regularly monitor performance and keep the software updated.

- Use a stable, low-latency hosting solution for consistent results.

Using VPS hosting can reduce latency, speed up trade execution, and ensure uninterrupted trading .

Your success hinges on choosing a robot that fits your trading style and maintaining a dependable setup. Whether you pick from our top recommendations or explore other options, focus on verified performance and rigorous testing before diving into live trading.