CrossTrade Pro v1.7 introduces smarter tools for automated trading, with a focus on risk management, position control, and performance improvements. Here’s what you need to know:

- Risk Management:

- Minimum Profit Drawdown (MPD): Automatically closes all positions if profits fall below a set threshold.

- Trailing Drawdown (TD): Protects peak profits by closing positions when a specified percentage of gains is lost.

- Position Management:

- FLATTEN Command: Close positions by account, instrument, or direction.

- CLOSEPOSITION Command: Scale out of trades by quantity or percentage for better control.

- Performance Upgrades:

- Faster order queuing and execution (34ms average).

- Improved multi-account management with grouping and custom order sizing.

- Subscription Plans:

- Standard: $19/month.

- Pro: $39/month, includes advanced risk tools and scaling features.

This update makes it easier to automate your trading while protecting profits and managing positions across multiple accounts.

Enhancing the TradingView to NinjaTrader Connection …

Risk Management Tools

CrossTrade Pro v1.7, integrated with the NT Account Manager, brings automated risk management tools to the table: Minimum Profit Drawdown (MPD) and Trailing Drawdown (TD). These features work in tandem to help protect your trading capital and lock in your gains automatically.

How Minimum Profit Drawdown Works

The MPD system is designed to monitor your session’s profit levels and safeguard your earnings:

- Sets a baseline profit threshold.

- Monitors your account balance every 2.5 seconds.

- Automatically closes all positions if profits dip below your specified minimum.

For example, if you set a $500 minimum profit threshold, the system will close all positions if your profits fall below $500. This ensures you retain that gain for the day. Now, let’s see how Trailing Drawdown takes this protection a step further.

How Trailing Drawdown Works

Trailing Drawdown dynamically adjusts to protect your highest profits during a session:

- Tracks your peak profit in real-time.

- Updates every 2.5 seconds.

- Automatically closes positions when the drawdown limit is reached.

For instance, if your account reaches a $1,000 profit and you set a 30% trailing drawdown, the system will close all positions if your profits drop to $700. This ensures you secure a significant portion of your peak earnings.

Setting Up Combined Risk Protection

Using MPD and TD together creates a layered system for managing risk effectively:

| Protection Layer | Function | Trigger Type |

|---|---|---|

| Minimum Profit | Sets a profit floor | Fixed dollar amount |

| Trailing Drawdown | Secures peak profits | Percentage of high watermark |

| Combined Effect | Multi-level protection | Activates at the most conservative trigger |

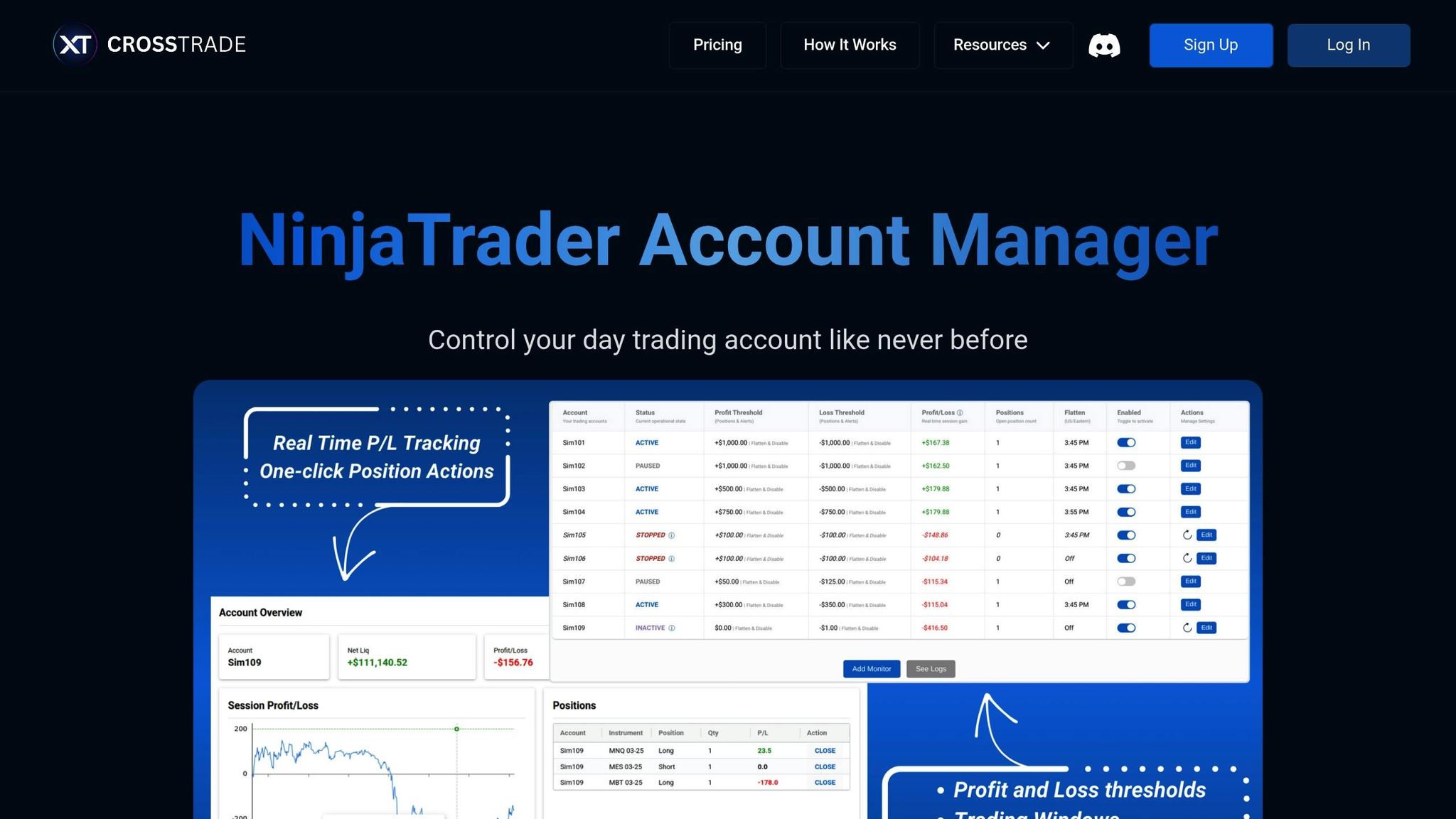

The NT Account Manager dashboard offers clear visual tools to monitor these systems:

- Real-time trigger lines showing current protection thresholds.

- High watermark indicators displaying peak profits.

- Progress bars showing proximity to stopout points.

- Management logs documenting all automated actions.

When a drawdown threshold is hit, the system automatically closes all positions and halts trading until manually reset. This layered setup not only protects your capital but also helps you make the most of your profit opportunities.

Position Management Updates

CrossTrade Pro v1.7 introduces improved tools for managing positions with updated FLATTEN and CLOSEPOSITION commands. These enhancements give traders greater precision and flexibility when handling positions across multiple accounts.

Enhanced FLATTEN Command

The updated FLATTEN command allows for more detailed control over position management. You can now close positions based on specific criteria, including:

- Account-specific targeting: Close positions in a particular account.

- Instrument-specific actions: Flatten positions for a specific instrument across accounts.

- Directional control: Target only long or short positions.

- Global flattening: Close all positions across all accounts.

Here’s an example: To close all short positions for the MES 06-25 contracts in a specific account, use:

key=your-secret-key;command=FLATTEN;account=sim101;instrument=MES 06-25;market_position=short;

If you want to close all long positions across your entire portfolio, you can use:

key=your-secret-key;command=FLATTEN;market_position=long;

These options provide a seamless transition to advanced scaling options available with the CLOSEPOSITION command.

Scaled Exits with CLOSEPOSITION

The updated CLOSEPOSITION command now supports partial position exits, allowing traders to scale out of trades using fixed quantities or percentages.

| Scaling Method | Parameter | Example | Result |

|---|---|---|---|

| Fixed Quantity | quantity=X |

quantity=2 |

Closes exactly 2 contracts |

| Percentage-Based | percent=X |

percent=0.5 |

Closes 50% of the position |

Here are examples of how to use this feature:

- Quantity-Based Scaling:

key=your-secret-key;command=CLOSEPOSITION;account=sim101;instrument=ES 06-25;quantity=2; - Percentage-Based Scaling:

key=your-secret-key;command=CLOSEPOSITION;account=sim101;instrument=ES 06-25;percent=0.5;

Key Notes:

- If both quantity and percentage are specified, the system prioritizes the quantity parameter.

- Percentage values are rounded up to guarantee at least one contract is closed.

- If the requested quantity exceeds the available position, the system adjusts to close only the current position size.

- For futures contracts, ensure that instrument names include exchange identifiers.

These updates make it easier for traders to manage their portfolios with precision and efficiency.

NT Account Manager Changes

The NinjaTrader Account Manager (NAM) in CrossTrade Pro v1.7 builds on earlier risk protection features, offering improved tools for account monitoring and automated risk management.

Live Performance Tracking

NAM provides real-time updates by scanning account metrics every 2.5 seconds. This allows users to instantly track session P&L and net liquidation high watermarks. By continuously monitoring both realized and unrealized profits, the system can quickly trigger automated actions when needed.

Additionally, the system automates end-of-day clean-up with improved flattening functions, simplifying position management.

Auto Account Flattening

CrossTrade Pro v1.7 introduces enhanced end-of-day (EOD) flattening to streamline position management:

| Feature | Description | Configuration |

|---|---|---|

| EOD Timing | Executes on server in ET (HH:mm) | "16:30" format |

| Execution Window | Retries every minute for 5 minutes | 5-minute retry period |

| Schedule | Weekdays only; excludes weekends | Auto-excludes weekends |

| Monitor Status | Respects STOPPED state; manual restart required | Manual restart required |

This server-side operation ensures positions are closed reliably, even if connectivity issues occur. These updates make account management more efficient and pave the way for enhanced alert handling.

Alert System Updates

The alert system now supports dynamic blocking, filtering, and note additions. Traders can block or filter alerts based on account status or market conditions, with all updates logged in the XT Activity Log and Web Dashboard.

For example:

key=your-secret-key; command=CLOSEPOSITION; account=Sim101; instrument=ES 06-25; notes=Closing half position at resistance level;

These updates integrate seamlessly with NAM’s risk management tools, making trading and account oversight more effective.

Technical Improvements

These backend updates boost CrossTrade Pro’s risk management and position handling capabilities while improving overall performance and reliability.

Order Processing Updates

The v1.7 release introduces a major update to the order queuing system in NinjaTrader 8. This change addresses request timeout errors, ensuring smoother and more responsive order execution.

Multi-Account Performance

Following the February 8, 2025 upgrade, CrossTrade’s multi-account management system now handles hundreds of thousands of alerts daily with reduced latency and faster execution speeds. New features like account grouping, custom order sizing, enhanced tracking, and advanced timeout settings provide users with better control.

| Feature | Update | Advantage |

|---|---|---|

| Account Groups | Grouping functionality added | Simplifies execution across accounts |

| Order Sizing | Individual customization | Tailored position sizes for each account |

| Order Tracking | Improved monitoring system | Better oversight for multi-account orders |

| Execution Control | Advanced timeout settings | More precise order execution control |

These updates integrate seamlessly with system-level monitoring improvements.

System Monitoring Updates

CrossTrade Pro now includes an end-of-day flattening feature, ensuring every trading session begins fresh. Enhanced session reset processes give traders more control over daily operations.

These technical upgrades create a more responsive trading platform, ideal for managing multiple accounts and executing high-frequency strategies.

Conclusion

What’s New in Version 1.7

CrossTrade Pro v1.7 brings improved tools for managing risk and controlling positions. The platform now handles over 100,000 alerts daily, with an average order instruction time of just 34 milliseconds.

This update combines Minimum Profit and Trailing Drawdown tools to offer better protection against risk. Additionally, the updated FLATTEN and CLOSEPOSITION commands make it easier to manage positions, letting traders scale out by quantity or percentage.

| Feature Category | Key Updates |

|---|---|

| Risk Management | • Real-time P&L updates every 2.5 seconds • Combined MPD and TD tools • Visual triggers and zones |

| Position Control | • Scale-out functionality • Multi-account flattening • Direction-specific closing |

| System Performance | • Faster order queuing • Improved dashboard responsiveness • Better alert filtering |

How to Get Started

Activating the new features in CrossTrade Pro v1.7 is simple:

- Step 1: Download and install the CrossTrade NinjaTrader Add-On.

- Step 2: Enable ATI within NinjaTrader.

- Step 3: Set up TradingView alerts using your Webhook URL.

CrossTrade Pro offers two subscription plans: the standard unlimited plan for $19 per month and the Pro version for $39 per month. The Pro plan includes advanced tools like active account management, trailing drawdowns, and profit/loss thresholds.